We would like to Introduce you to one of our Traders, Elay Ghaly.

Below you will find out more about his journey on how he became a trader at Trade View.

Introduction

Since a very young age I was always curious about the intrinsic price and value of something. As a young kid I traded basketball cards at school. I realised I could buy them cheap, I could sell them for a profit.

So I did.

I took the same approach and applied it to CD’s, and then to computer hardware and peripherals, which has always been a side passion. I’ve never been a salesman, but I know a good deal when I see it.

After initially studying engineering/computer science at uni, I decided to make a move to Business IT. Whilst completing my degree I was fortunate to intern for one of Australia’s leading stockbrokers here in Collins St, Melbourne. During that time I caught the bug, the chaos of the financial markets and everything that came with it.

Brief background about your trading

My first “trade” was back in 2004 in a childcare company. I had no idea what I was doing, but I bought 1000 shares at $1 IPO and sold it a few months later at $1.68. I was hooked. This had to be the way forward.

After completing my degree I pursued a career in IT, only to realise this wasn’t what I wanted for the rest of my life. So I started learning about the markets and trading prior to the GFC. Those days I was trying to soak in anything and everything, reading anything I could get my hands on. After filtering through much of snake oil and “free” information on the internet, I quickly learnt who was the real deal in this industry and who wasn’t.

And so the journey began, studying hundreds of charts a day, purchased hundreds of expensive books and watched all kinds of markets in real-time.

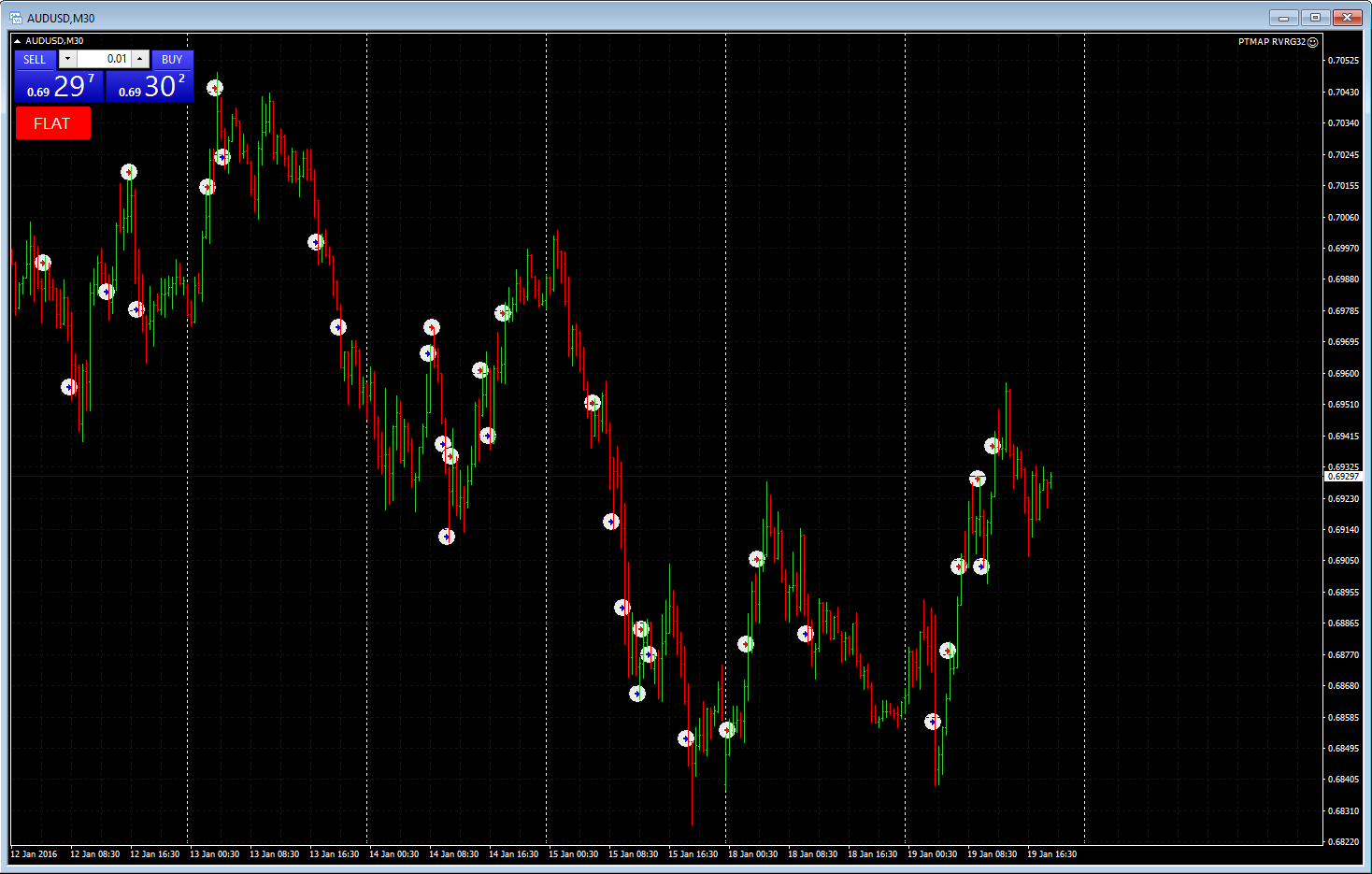

In 2007 I began creating my own methodology using geometry, patterns, momentum, statistics and price action. I trade this method today called ‘PTMAP’.

Fast forward to 2015 I decided to leave IT for good and haven’t looked back.

What you learnt at Trade View

I contacted the guys at Trade View because it was time to start thinking about automation, for two main reasons:

1 – Time:

Sitting in front of the screen all day was hard work, and I wanted to alleviate some of my screen time by having algorithms execute for me, so I can focus on looking at other strategies, other markets, different timeframes, and other aspects in life.

2 – Testing:

Prior to completing the Intermediate Workshop, I always backtested bar by bar and noted results into Excel. To give you an idea I have some spreadsheets of 1 minute strategies with over 20,000 backtested rows, all manually done. This sort of testing was rigorous, painful, time consuming (some tests took weeks and months).

Looking back I learnt a lot about the markets testing this way, but it was a complete and utter inefficient use of my time, and I’ll never do this again.

After meeting Rob at Trade View I learnt how to build my ideas in an hour. Test them in minutes. Granted being well versed in IT helps but anyone can do it. Not too mention review and analyse results in seconds. It was just another world.

Please share some of your success and failures as a trader.

There are many.

The first was obviously being offered a seat on the desk, for many a priceless opportunity. The experience and lessons you gain from sitting on a trading floor are like none other.

Obviously with trading you can never sit on your laurels thinking you’ve “made it”. Markets have a habit of testing everyone at some stage so you have to be able to adapt.

Of the failures, I’ve made all the mistakes retail traders make. All mainly due to over leveraging and overexposure. The Intermediate Workshop and Trader Development programs go a long way to explaining risk management done the right way, not just by simply risking 1 or 2% on any trade. It is a good start, but there are other risk management models worth considering.

I’ve since designed many systems. A recent example was a model we completed over the break in the space of 2 days. With exhaustive testing over many months we’ve since deployed the model.

Below you will find a snapshot of the AUD/USD, one of the pairs traded in the portfolio.

Conclusion

Looking back all these years had I known who to follow, or have someone to help me along the way would’ve saved me countless hours, scratching my head looking for answers.

If you are profitable, fantastic, keep at it. If you are not, look in the mirror, stop what you’re doing and GET SOME HELP from a professional. It doesn’t have to be the guys at Trade View.

Most importantly:

- Find someone you can relate to, resonate with and understand. There is no point getting help from someone who does not know who you are, where you’re at with trading, and where you want to be.

- Make sure they actually trade day in day out, as opposed to the “educators” out there. If they are not risking their own money, they have nothing to lose. They only stand to gain by taking your money.

When it all comes down to it I really do think the secret is this:

“Those who want it will find a way. Those who don’t will find an excuse”

What are your future Goals?

The main goal now is to build a more diversified portfolio of automated strategies, towards managing a large fund, and help those who have the same goal.

If you have questions we’d be happy to discuss in more detail with some laughs along the way, just please don’t waste our time because we’re busy trading 🙂

Happy trading.

Phone : +613 9018 5438