From trading Comic Book Cards to building multiple algorithms, Shivam has come a long way in his trading.

Read his Trader Profile and discover how the decision Automate his Trading proved a successful one.

Introduction

I am a final year student at Macquarie University studying Accounting and Finance. I’ve always been interested in trading – whether it be stocks, or forex, or even just trading cards. The idea that you could start off small, and then work your way up to something big has always been fascinating to me, and trading allowed me to achieve that.

From an early age, I realised that I didn’t want to work in a standard role doing the same thing all day and when I think of trading, all I can think is that there is something new that pops up every day; and it will always be a new challenge. I was lucky enough to stumble across Trade View and they really helped me to build my passion from the ground up.

Brief background about your trading

My first memories of trading were Pokémon and Yu-Gi-Oh Cards. I loved amassing a collection by trading cards smartly. I also played a lot of video games when I was younger, and often, there was some sort of economy within the game allowing you to trade items for money. I probably enjoyed that way too much. During high school, I played the ASX Share Market Game. From then onward, I’ve always wanted to trade.

From there, I went online and chose a random broker and started manually trading on a demo account. Obviously, I wasn’t very good, but it was a lot of fun and it gave me a rush when I made a lucky profit. I heard of Trade View through that broker and ended up watching one of their webinars. I was instantly amazed with what professional traders do and can achieve through proper discipline. I then went through both the Beginner and Intermediate Programs and my journey into live trading began from there.

What you learnt at Trade View

I’ve watched plenty of their Trading Talks and their webinars to understand that what I knew about trading was pretty much all wrong. Trade View emphasised that trading isn’t only about making the most money on a trade but also about managing risk. The Introduction to Markets taught me a lot about trading as a whole, while the In-House Systems Building Workshop delved much further into Forex specifics. They also taught me how to use Trade View X which has enabled me to compete with traders that do have programming experience whereas I have absolutely no knowledge. Within a remarkably short period of time, and with consistent effort on my part, I went from essentially gambling on currencies to formulating strategies of my own and building my algorithms and my first portfolio. I’ve had consistent help along the way. Anything I didn’t understand, I’d shoot off an email and get a reply from Trade View the following day.

Please share some of your successes and failures as a trader

I was absolutely stoked when I created my first full algorithm that worked with an idea that I thought of myself. There were plenty of bumps along the road. To date, I have probably made 13 separate algorithms, each with a slightly different concept before I finally created one that provides consistent results.

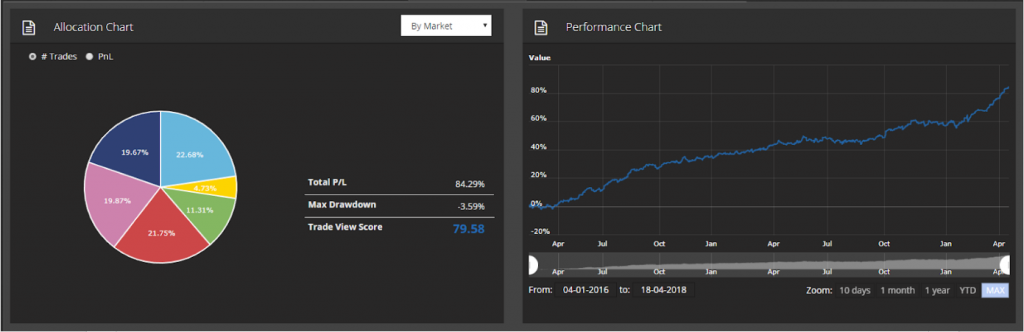

The photo below shows my first portfolio. It’s an algorithmic model I built from scratch and applied across a couple of products and spans across a two-year time frame. Now, while I still have a long way to go in terms of improving the profit, equity curve and the draw down, I was pretty happy at my first attempt and will definitely continue to both build more and improve my current models.

What are your future goals?

Over the last weeks and months, automated trading really worked for me. Firstly, one focus for the near future is to slowly build up a pool of external capital to trade and improve the trading systems and their robustness. The optimization features of the trading platform are tempting to squeeze maximum profit out of the trading systems, but my personal preference is to look for robustness, diversification, and low draw down. The yield of my portfolio already exceeds anything that any bank in Europe offers by far. Secondly, I plan to continue my research into AI systems. I imagine these are not going to be magic wants that cry out “Buy!” or “Sell!” with infallibility, but additions to already existing systems. Let‘s see how that works out!