We would like to Introduce one of our Students who completed our In-House Systems Building Program in November 2015 and is on his way to becoming a Full Time Trader.

Below you will find out more about his journey.

Introduction

My trading journey began around 1994. I had invested in a few blue chip ASX stocks and was following the late Garry Jones who wrote a weekly column under the name of ‘The Chartist’ in The Age newspaper. It was he who introduced me to Technical Analysis or ‘Charting’ in his Monthly Sunday tutorial at the Box Hill Motor Inn.

I was hooked from my first of many Sundays. I listened and watching him demonstrate using a very early version of MetaStock- how a simple moving average crossover was a way to beat the market and provide a pathway to vast wealth. Needless to say, after setting myself up with all the necessary computer wizardry, I was to discover that this was only the start of a much longer journey.

Since then I have attended many workshops and seminars on the subject of trading and in 2008 I completed the Diploma of Share Trading run by Wealth Within Institute, Australia’s first nationally accredited trading course. I am a long term member of the Victorian chapter of the ATTA and regularly attend their monthly meetings which I recommend to any aspiring trader.

Brief background about your trading

Since I opened my first trading account in 1995, I have traded Stocks, Futures, CFD’s and Forex. Over this time I have come to realise that the difference between inexperienced traders and the pro’s is consistency. Ideally a trading system should be almost mechanical, in that trading opportunities are identified by specific parameters and trades are taken only when those parameters are present.

The advent of charting software has given traders the tools to make this more possible than ever but testing them individually in the search for the ‘Holy Grail’ is a full time endeavour which often leads to frustration and poor performance. Accordingly I have formed the belief that trading is a business in which an experienced mentor can play a very important role, however finding the right one is not easy.

What you learnt at Trade View

When I first encountered Rob and his team, I was immediately attracted by their professionalism. Here was an organisation where part time traders could actually mix with and learn from professional full time traders who trade for a living.

After an initial introductory meeting I enrolled in the In-House Systems Building Program and spent two stimulating days experiencing a whole new approach to trading. Understanding how to build and backtest trading strategies through automation is a huge step forward in finding and testing a strategy that suits your personality and lifestyle.

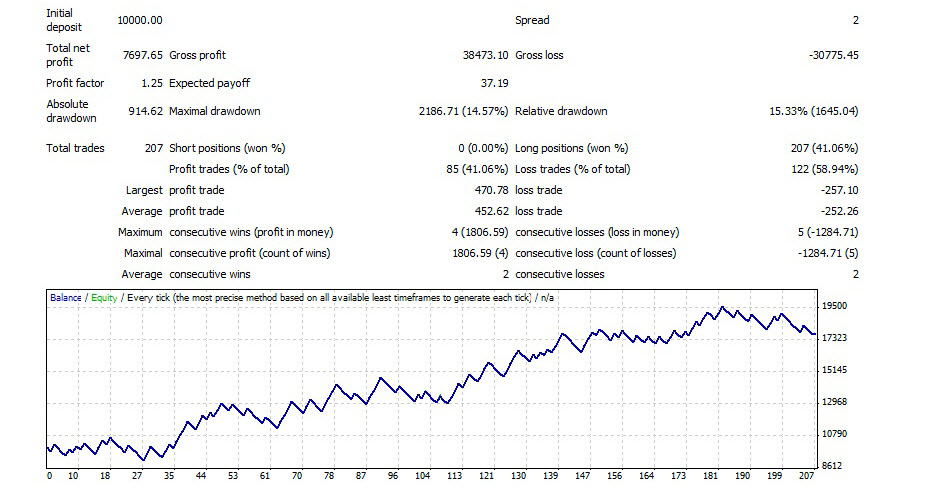

Below is a sample of the current strategy I am working on, tested on the AUD/USD:

Please share some of your success and failures while learning to trade.

In Mark Douglas’s book ‘The Disciplined Trader’, he states that trading is 80% psychological and 20% one’s methodology. This has been my experience, as most of my failures can be attributed to a lack of discipline. In other words, not following the rules of my trading plan. Overtrading or selecting the wrong position size, not adhering to stop losses or making trading decisions based on instincts or emotions, rather than careful analysis or reasoning can all contribute to catastrophic losses.

Conclusion

What are your future Goals?

To date, I have spent many years/hours trying to reach a point where I could confidently trade full time for a living. With the help and guidance of the team at Trade View I believe I’m not too far away from this goal.