We would like to introduce Rennie who recently completed our In-House Intermediate Program, and is also on his way to becoming a full-time trader!

Below you will find out more about his journey.

Introduction

When I was a kid I asked my mum- “Mum, why don’t people buy lots of American dollars and then exchange them back to Australian dollars once the American dollar is worth more?”; to which she funnily enough replied: “No Rennie, that is illegal.”

10 years on I actually ran into a young man that did this for a living. He explained the word “Forex” and started teaching me about it! I was intrigued by the thought and in the back of my mind I always strived and wanted to achieve my financial goals. I said to myself: I want to be a millionaire one day and set on the slippery path to try do so.

Whilst that goal is a long way away I believe I can do it and have what it takes to do so. I’m a 21 year old I.T Technician with a diploma in Information Technology Networking, and one day I’m going to be a professional trader for a living.

Brief background about your trading

When I started trading in January 2014, I thought it was going to buy me a house within a year or two. OH HOW WRONG I WAS!

The harsh reality was I actually had a bit of rookie luck on a demo, and thought it was easy to then put my own money into a real account. After winning a bit and then losing more, I had done the dreaded move of blowing up my first account. I then refunded the account and did it again! After the second time I started taking this game a lot more serious. I knew that I needed to respect the market as it doesn’t do what I want it to do; it does it’s own thing.

I started reading, reading and reading some more. I learnt that you have to strive for success to make it to that 5% that can trade and make it work for themselves. Trading only Spot FX I then diversified into Commodities; which then led to trading indices. I started learning a little bit more about what moves the market and started trading Stock CFD’s. Then one day I came across Trade View, and started talking to Rob the Head Trader. I quickly learnt I could take my trading to the next step and take a professional approach to trading, set my career path to trade for a proprietary firm, and become a professional trader utilising automated trading.

What you learnt at Trade View

After completing the Intermediate Workshop on the 12th and 13th of March in 2016, I found the last 20% that I needed for a professional approach to the markets. Topics such as Risk Management, Market analysis, certain dangers; and lastly what I wanted most- how to automate my trading and strategies in the market.

Learning in person was one of the best things I did to take my trading to the next level.

This meant a change in mindset from viewing the market as a retail trader, and instead looking at it like a professional trader. There were many key topics that don’t cross your mind when you’re trading by yourself- things you ACTUALLY need to think about each and every day you open the chart. These are the things that Trade View can teach you and make you aware of, to give you that edge in the market. After completing the workshop I’m now on track to trading my own systems and finally have a professional approach in the market. I think one of the biggest things I can take away from the workshop is being disciplined and have a good risk management plan.

Also- moving from manual trading to Automated trading helps you remove all bias and emotion from your trading; allowing you to trade exactly how you want to. I know a lot of traders who have revenge traded or tried to double up the next trade to make their losses back. This just doesn’t happen and more you may possibly lose more than what you bargained for. Take the next step and go and see the guys at Trade View, and let them help you.

Please share some of your success and failures while learning to trade.

I have been trading on and off over the past 2 years. During this time, I have been fortunate enough to come out in front after blowing up two accounts early on.

One of the big events over the last few years was surviving the Swiss National Bank peg removal. I was watching a 15 minute chart at the time and saw a 400 pip move on a 15 minute candle. Over the next few seconds it COLLAPSED another 1600 pips and it was done! Many traders lost money, some would have obviously gained; but thankfully I was not in a position at the time to experience the bad side to say the least. In all it has taken me many hours and lots of screen time to become profitable. After some initial rookie success on a demo account, I soon found out the harsh reality that trading wasn’t easy, and it was only through lots of persistence and dedication I became the trader I am today.

To date the IIn-House Intermediate Program at Trade View was my first course and only course that I have attended and I really couldn’t be happier. It was an amazing experience with some great traders!

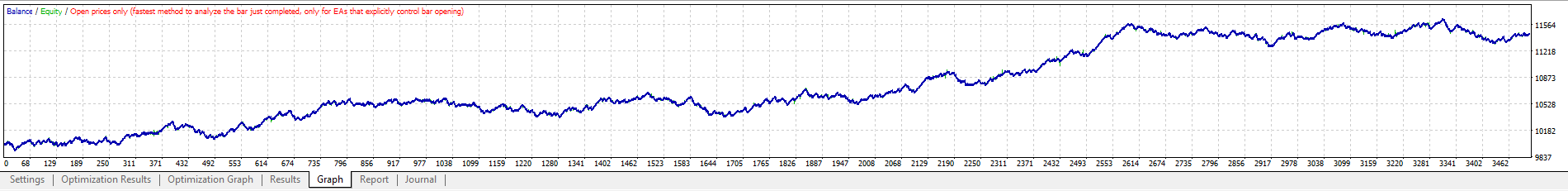

Below is a system that I am currently refining and have been testing on a demo account. And the best part is it only goes short! Here is a test of it:

I am still refining and testing this but it should be a great system once finished.

Conclusion

What are your future Goals?

I am now working on some systems as a portfolio to trade in diverse ways.

My 5 year plan is to leave work and if I am not trading for myself, then be trading on a propriety trading firm or fund. Thankfully I am still young so the sum of 7 figures is possible as long as I work hard at it, and persevere in this market and industry. I believe if I can get onto a desk my trading will go to the next step and I will become the best trader I can be.

From there, who knows maybe one day I’ll get the chance to own that McLaren 650s and live my own way!

If you have any questions feel free to contact me on the Trade View chat room. Meeting and keeping in contact with fellow traders is a great privilege!